Cranbrook City Council formally adopted the 2021 Tax Rates Bylaw on Monday, leading to a 2.35% increase in residential taxes, which includes a general increase of 1.35% and the 1% dedicated road tax.

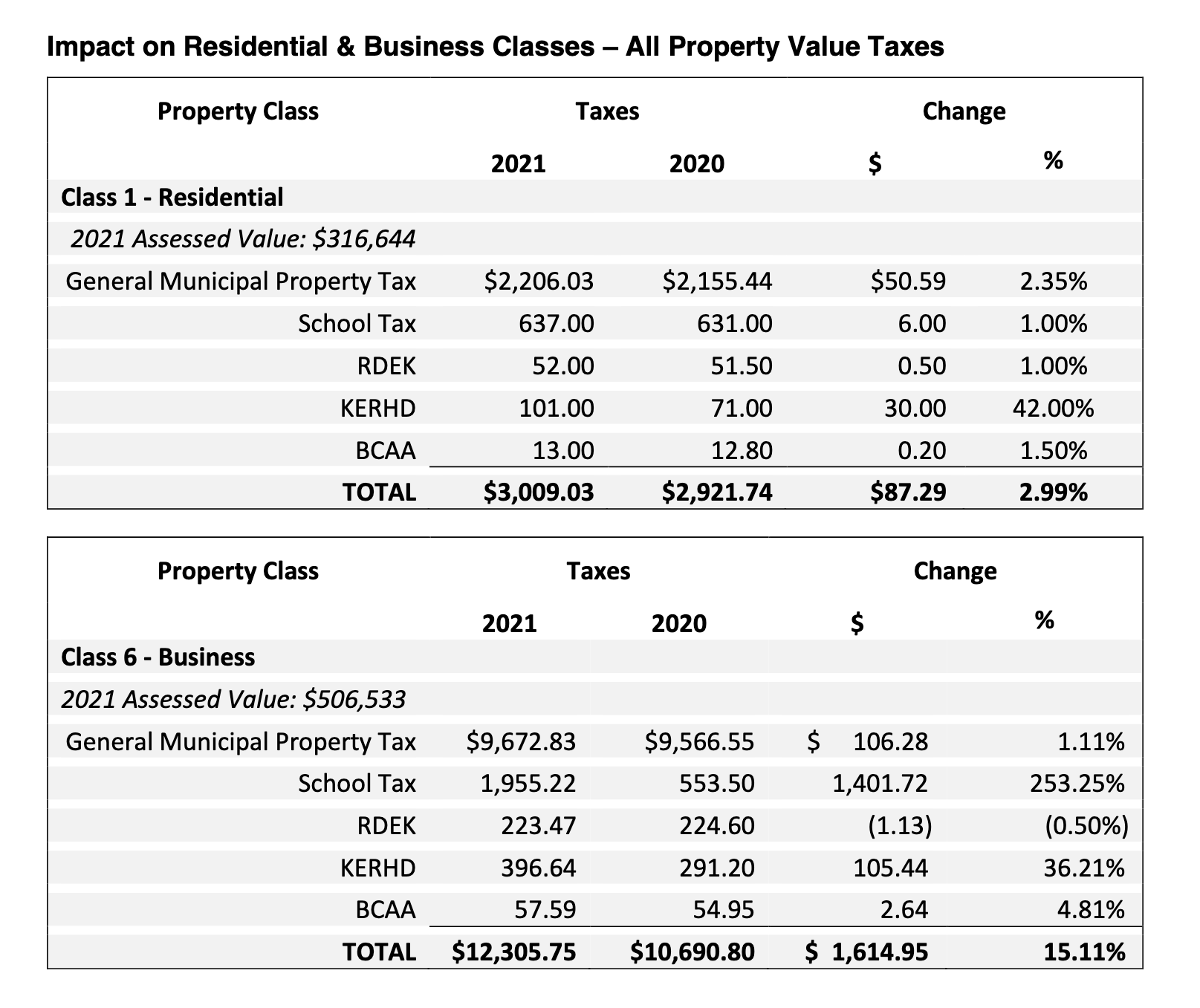

For an average residential assessment of $316,644, most homeowners will witness a $50.59 increase in their property taxes.

“I know that people are always not happy with tax increases but the bottom line is that this was a lot of time and effort and work put in by the staff and our finance department and the Council,” Mayor Lee Pratt told MyEastKootenayNow.com in late April when the proposed Tax Rates Bylaw first came across City Council’s desk.

“I think everybody knows that the City’s expenses have certainly increased more than 1.35% over the last year so I think it was a great job.”

The tax increase for business is subsequently rising 1.11% for an average increase of $106.34.

When incorporating the various other implications to property taxes including the portion to the RDEK (Regional District of East Kootenay), the KERHD (Kootenay East Regional Hospital District), and the school tax, Cranbrook’s residential homeowners will pay an extra $87.29. The average increase will be 2.99%.

For businesses, the all-encompassing tax rate changes will lead to a 15.11% increase or $1,614.95. That large increase is mostly due to the 253.35% increase in the school tax.

MORE: 2021 Tax Rates Bylaw (City of Cranbrook)

PREVIOUS: Cranbrook proposing 2.35% tax increase in 2021 (April 28, 2021)